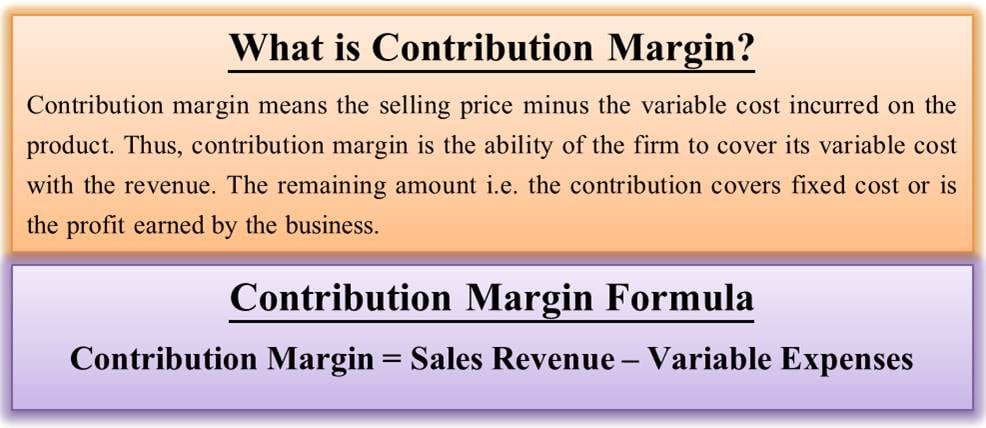

A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? In accounting, contribution margin is the difference between the revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product. It means there’s more money for covering fixed costs and contributing to profit.

Analysis and Interpretation

You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue. Overall, per unit contribution margin provides valuable information when used with other parameters in making major business decisions. The real power of understanding cost behavior comes into play when making critical business decisions. To set the right price for a new product, you must grasp how your costs will change as sales increase. When planning for future growth, cost behavior analysis helps predict how expenses will scale as your business expands. It even plays a vital role in break-even analysis, helping you pinpoint exactly when your venture will start turning a profit.

Contribution Margin Ratio:

The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time.

How can a business increase its Contribution Margin Ratio?

These courses dive into the economic forces shaping markets and teach practical skills for making smart business decisions. To stay competitive, they increasingly turn to sophisticated tools like cost behavior analysis and contribution margin calculations. These financial metrics provide essential insights that can significantly impact a company’s profitability. Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs.

Variable costs, on the other hand, increase with production levels. Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled.

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business. The gross sales revenue refers to the total amount your business realizes from the sale of goods or services. That is it does not include any deductions like sales return and allowances.

- Any remaining revenue left after covering fixed costs is the profit generated.

- Whether you sell millions of your products or 10s of your products, these expenses remain the same.

- Thus, you will need to scan the income statement for variable costs and tally the list.

- This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas.

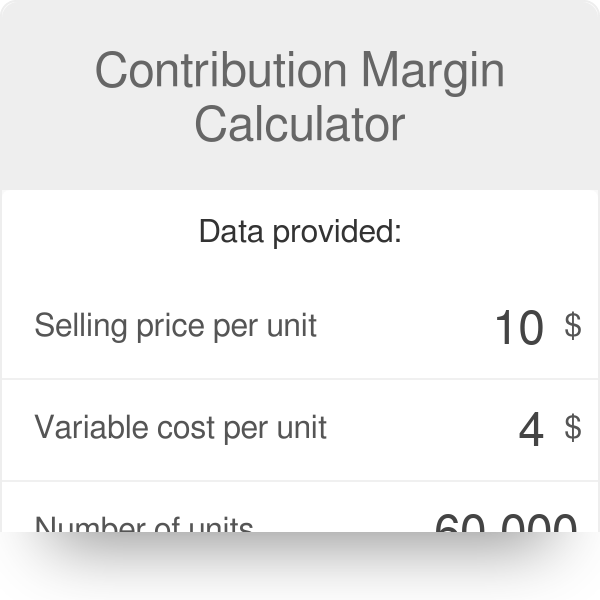

For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable merging math and music in an accounting firm costs. The Contribution Margin Calculator is an online tool that allows you to calculate contribution margin. You can use the contribution margin calculator using either actual units sold or the projected units to be sold. Now, the fixed cost of manufacturing packets of bread is $10,000.

Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. Let’s begin by examining contribution margin on a per unit basis. The contribution margin income statement separates the fixed and variables costs on the face of the income statement.

A higher unit contribution margin indicates that a product is more profitable and contributes more towards covering fixed costs and generating profits. Conversely, a lower margin may signal the need to review costs, pricing strategies, or product offerings to improve profitability. As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services. This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.