Visa Conditions and you will Limitations

In addition, Foreign Funding Comment Board (FIRB) approval becomes necessary having low-long lasting customers to acquire possessions around australia. As much as 80% of one’s price is going to be borrowed, with an effective 20% deposit together with can cost you required.

Protecting a deposit with a minimum of 20% as well as 5% to cover extra expenditures such stamp obligations, with somebody functioning full-day, having a positive credit score around australia, and you may showing voice discounts strategies whenever you are understanding is always to assist in improving the fresh new chances of home loan acceptance.

Adult Advice and you can Guarantors

An effective guarantor try someone who undertakes to assume obligations for that loan when your debtor is unable to fulfill their cost obligations. With a great guarantor (constantly a dad) can improve likelihood of loan approval and relieve the total amount from put necessary for around the world people.

Certain requirements for having a great guarantor can vary with regards to the bank, but fundamentally, they want to features a confident credit score, an established income source, and you will very own a home. The process having acquiring a guarantor generally speaking necessitates the guarantor so you’re able to signal that loan agreement and gives proof of money and you may borrowing history.

Increasing Your odds of Mortgage Acceptance

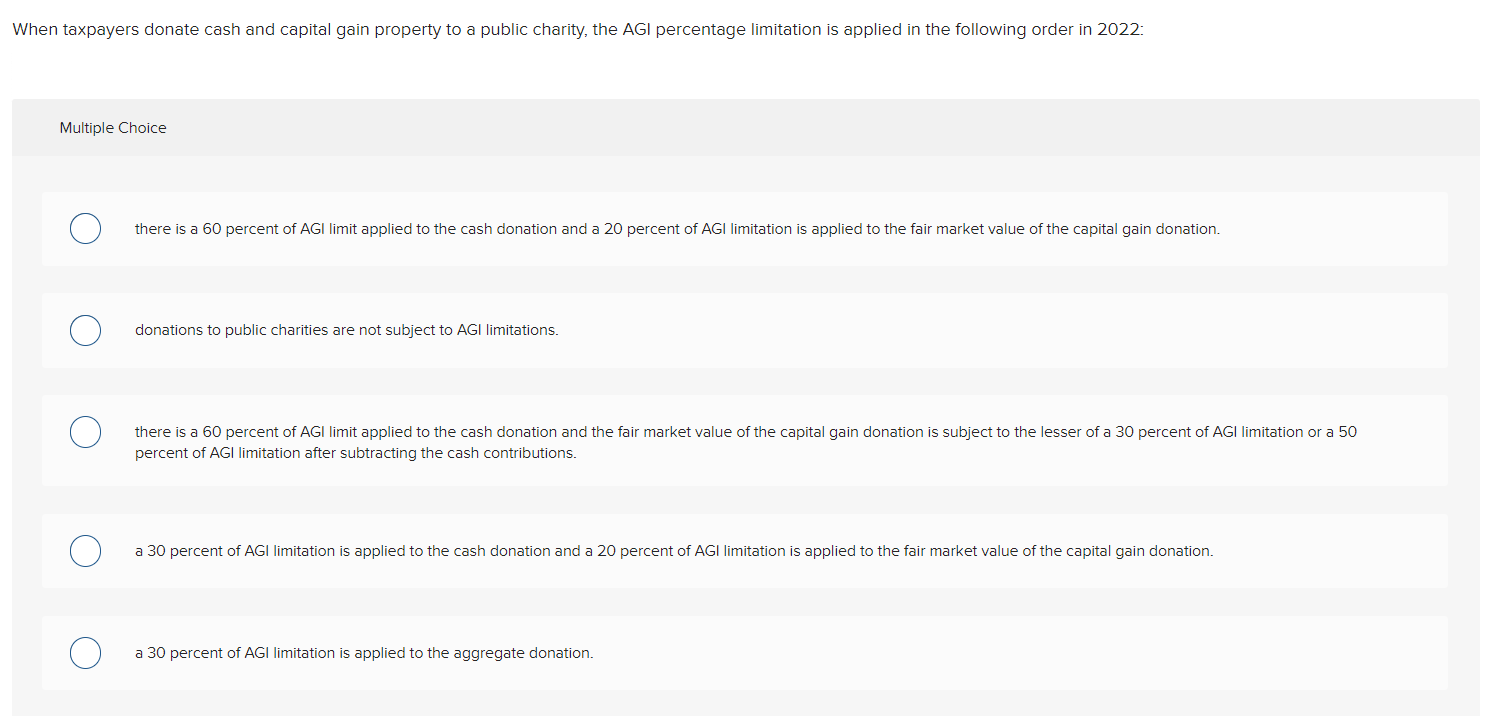

To improve the probability of mortgage approval, it is essential to have an excellent credit score, have indicated genuine deals, manage a reliable income, and reduce established private expense. In addition, you will need to submit an application for the right amount and comment the fresh eligibility standards.

Maintaining a good credit score is important to own financing recognition as this means so you can loan providers that you are a professional borrower and are leading to satisfy the mortgage cost.

Strengthening a good Credit rating

A credit score away from 661 or 690, with respect to the score’s selection of 1,200 otherwise step one,000, is considered as a great credit score. Starting this rating involves and also make timely money, maintaining the lowest borrowing application proportion, and achieving an extended credit score.

Maintaining a confident credit history is beneficial as is possible possibly qualify that for much more positive mortgage terms and interest rates, thus showing monetary duty.

Rescuing to own in initial deposit

Preserving having in initial deposit is important for loan recognition as it indicates to help you loan providers that you contain the necessary financial resources to satisfy the financing payments. A deposit out of ranging from 20% and you can 29% of your own overall amount borrowed, that have an additional 5% needed for get will set you back, is typically needed for scholar home loans.

When preserving up with the deposit, you could potentially choosing the most affordable student rental in the Brisbane otherwise any type of urban area you happen to be surviving in to reduce down costs.

The number one way of protecting having in initial deposit is to identify an objective count, monitor expenditure, introduce a feasible finances, find a savings account having an aggressive interest rate, and you may present automatic deals.

Appearing Constant Earnings

Steady money means a typical and you can credible income source which you can use to demonstrate financial balances. With someone or constant earnings can increase the likelihood of mortgage approval while the lenders be the cause of domestic money whenever evaluating a loan application. This will make it easier for one or two candidates to-be recognized, particularly when you’ve got a frequent complete-big date earnings.

Maintaining a professional earnings, promoting spend stubs or taxation statements, and you can demonstrating a robust discounts history are the most effective actions for exhibiting uniform money.

Navigating our home Mortgage Processes

Your house mortgage techniques concerns several strategies, starting with pre-approval, followed closely by application, underwriting, and finally closure. So you can no bank account loans Putnam AL initiate, people have to sign up for a conditional pre-approval, then come across property and implement having a home loan.